tax sheltered annuity vs 403b

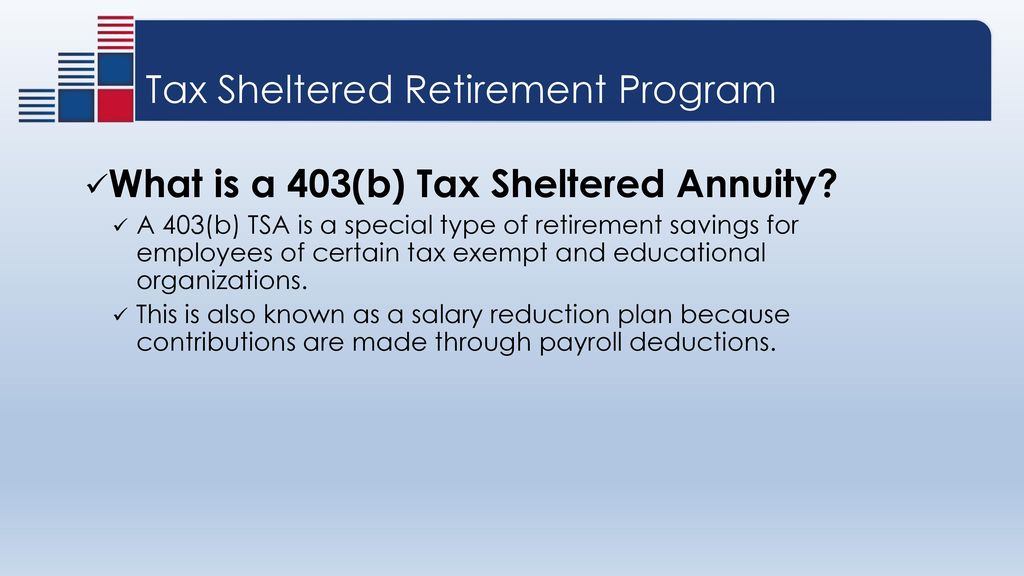

These withdrawals are usually in the form of payroll-deducted pre-tax contributions. The UW 403b Supplemental Retirement Program SRP formerly the UW Tax-Sheltered Annuity TSA 403b Program allows employees to invest a portion of their income.

Contributions you make to a 403b plan arent taxed until you withdraw the money.

. Generally the amounts an individual withdraws from an IRA or retirement plan before reaching age 59½ are called early or premature distributions. Enter the email address you signed up with and well email you a reset link. Defined contribution pension plans are also subjected to an early withdrawal tax of 10 if the funds are withdrawn before the age of 59 years.

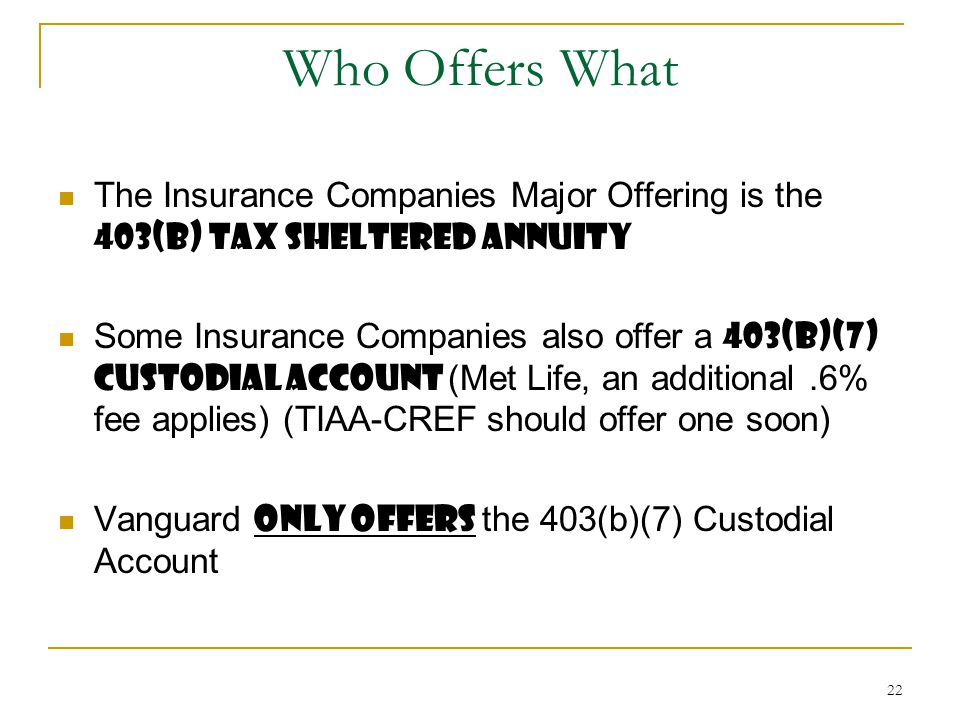

Internal Revenue Service. These plans are similar to 401k plans but investments are limited to annuities and mutual funds. Friday November 4 2022 Time.

Most retirement plan distributions are subject to income tax and may be subject to an additional 10 tax. While times have changed and 403b plans can now offer mutual funds as noted many still emphasize annuities. Governmental deferred compensation plan section 457 plan Because of the law change your 403b is now eligible for a direct rollover distribution into your Roth IRA.

However this restriction was removed years ago. Be informed and get ahead with. SRP Advisory Committee upcoming meetings SRP Advisory Committee Meeting.

This is also referred to as Tax Sheltered Annuity TSA plan. We would like to show you a description here but the site wont allow us. 1000am 200pm Location.

In the past 403b plans restricted their participants investment options primarily to variable annuities. A 403b plan is a tax-sheltered annuity plan offered by tax-exempt employers. Annuities come in many forms.

Tax-sheltered annuity plan 403b plan Employers qualified pension profit sharing or stock bonus plan including a 401k plan Annuity plan or. 403b plan is a retirement plan similar to 403 b for employees of public schools and tax-exempt organizations. Tax Sheltered Annuity Plans 403b Plans Page 13.

So if you wanted to perform a. Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more. Your investment grows tax-deferred.

When the 403b was invented in 1958 it was known as a tax-sheltered annuity. Although annuities have high fees and other charges they can be a useful investment to add to a retirement portfolio. If youre concerned about outliving your retirement savings an annuity could be a logical way to guarantee a fixed income until you pass away.

In fact these plans get their name from the section of the tax code concerning tax-sheltered annuities. Individuals must pay an additional 10 early withdrawal tax unless an exception. A Tax Sheltered Annuity TSA is a pension plan for employees of nonprofit organizations as specified by the IRS in accordance with section 501c3 and 403b of the Internal Revenue Code.

Taxsheltered Annuity Plans Also Known As 403b Plans

403 B Plan Versus 401 K Plan Fairlight Advisors Llc

403 B Roth 403 B Plans National Retirement Group

The Tax Sheltered Annuity Tsa 403 B Plan

403 B Roth 403 B Plans National Retirement Group

Taxsheltered Annuity Plans Also Known As 403b Plans

403b Tsa Annuity For Public Employees National Educational Services

Massmutual What S In A Name A Retirement Plan Comparison

The 403 B The 403 B What Is It What S Wrong With It Ppt Video Online Download

403 B Tax Sheltered Annuity Plans Tsa S Longmeadow Ma

Tax Sheltered Annuity Faqs Employee Benefits

Withdrawing Money From An Annuity How To Avoid Penalties

403b Withdrawal Rules Pay Tax On Retirement Income

The 401k Vs 403b Plan Find The Legal Difference Between Cc

/annuity-c64facb507ac4b1c99b1ac5ba9bac1a8.jpg)